Fundamental analysis is a technique for assessing a company's financial standing and potential for growth in order to determine if a security is undervalued or overvalued in the market, allowing investors to make educated investment decisions on whether to buy, hold, or sell the security.

The steps to undertake a fundamental analysis are as follows:

- Understand company's financial statements- Review the balance sheet, income statement, and cash flow statement to understand the company's financial health, revenue, expenses, and cash flow.

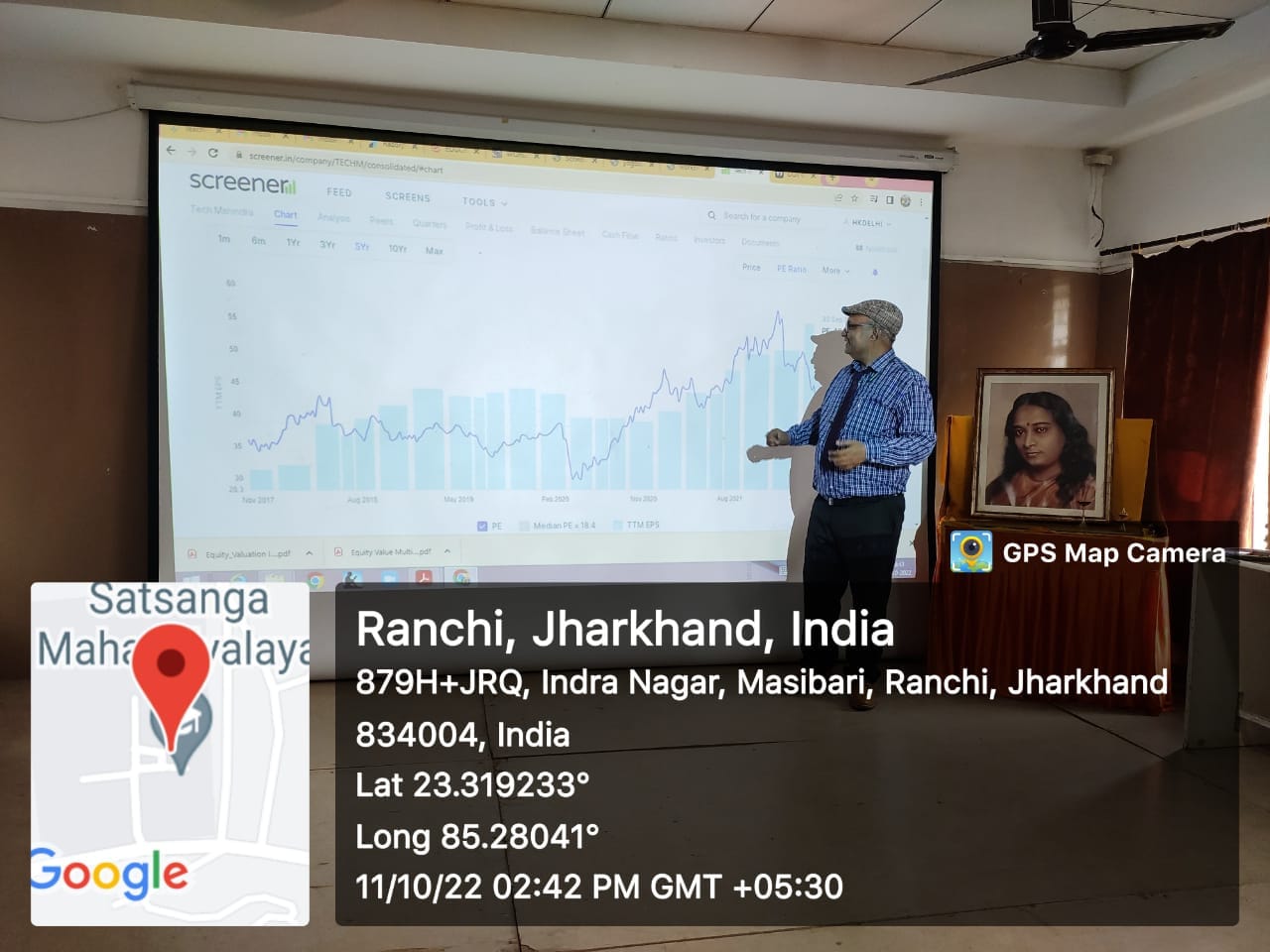

- Look at key financial ratios- Use financial ratios such as the P/E multiple, EBITDA multiple, D/E ratio, and return on equity (ROE) to gain insights into the company's profitability, financial leverage, and efficiency.

- Analyze the industry- Research the industry to understand trends, competition, and market growth potential.

- Evaluate the management- Evaluate the quality and stability of the company's management team and their capacity to make strategic decisions.

- Consider the company's growth prospects- Examine the company's expansion potential, taking into account its competitive positioning, upcoming product and service offerings, and expansion possibilities in new markets.

- Review news and analyst reports- Keep up with the company's most recent developments and potential futures by reading news stories and analyst reports.

- Determine the security's true value (intrinsic value) using a variety of techniques before making an informed decision about whether to buy, hold, or sell the asset.

A fundamental analysis is just one part of the process used to decide which investments to make, therefore it's vital to bear in mind that before making any judgements, it's best to take other aspects into account such as technical analysis and market circumstances.